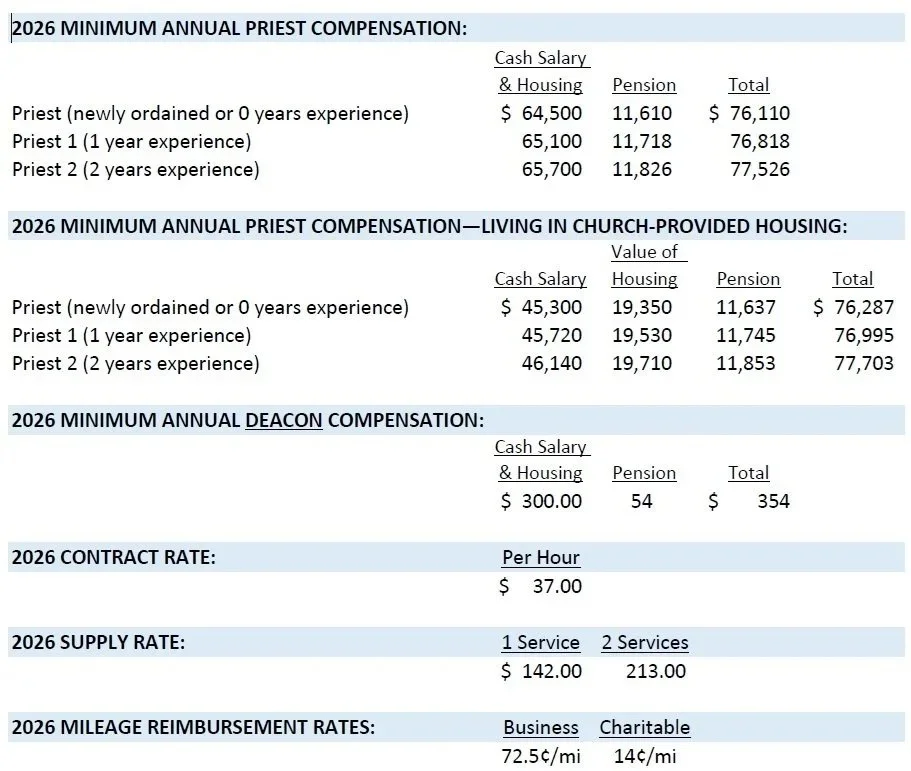

DIOCESAN MINIMUM CLERGY COMPENSATION SCHEDULE

A Minimum Clergy Compensation Schedule is established by the Diocese each year for priests and deacons. This schedule also includes rates for supply clergy, mileage reimbursement, health and life insurance.

STANDARD IRS MILEAGE RATE

EFFECTIVE JANUARY 1, 2026, the IRS standard mileage rate for business will be 72.5¢ per mile

The 2025 IRS standard mileage rate was 70¢ per mile

TAX GUIDES FOR CLERGY AND CHURCHES

DIOCESAN EMPLOYEE COMPENSATION & BENEFITS POLICY

View Employee Compensation & Benefits Policy (effective January 1, 2016)

View Policy on Healthcare Benefits (effective January 1, 2016)

View Sabbatical Policy for Clergy and Lay Employees (effective March 9, 2024)

Clergy: Compensation includes cash stipend and housing allowance. Benefits include pension, health insurance, group life insurance, vacation, sick leave, continuing education leave, and professional development leave or sabbatical.

Lay Employees: Participation in an Episcopal pension plan is required for lay employees that are paid for a minimum of 1000 hours per year (~20 hours/week). Episcopal health and dental insurance is required for employees that are paid for a minimum of 1500 hours per year (~30 hours/week).

CHURCH COMPENSATION REPORT

From Church Pension Group, this annual report is a national, provincial, and diocesan analysis of clergy compensation. (View reports from previous years)