Policy on

IOWA DIOCESAN FOUNDATION FUND

June 28, 2013

TABLE OF CONTENTS

Executive Summary

Purpose

Background

Statement of Objectives

• Time Horizon

• Risk Tolerances

• Performance Expectations

• Asset Allocation Constraints

• Rebalancing of Strategic Allocation

Securities Guidelines

Selection of Money Managers

Control Procedures

• Duties and Responsibilities of the Money Managers

• Brokerage Policy

• Performance Objectives

• Monitoring of Money Managers

EXECUTIVE SUMMARY

Type of Fund: Endowment / Long-Term Investment Account

Assets as of December 31, 2012: $9,649,830

Aggregate Target Long-Term Return: CPI + 3%

Alternative assets

Satellite/Alternative asset categories might include, but are not be limited to, REITS, High Yield Debt, Commodities, Hedge Funds and Foreign Debt. It is generally recognized that these types of asset classes are not highly correlated to domestic and large cap international stocks. The use of noncorrelated asset classes is intended to provide broader diversification to the portfolio and to reduce overall portfolio volatility. Alternative asset classes are counted as part of the equity exposure.

Evaluation Benchmark

Total return is expected to meet or exceed performance of a Balanced Fund database or a weighted index of appropriate indices.

PURPOSE

The purpose of this investment policy statement (IPS) is to establish the investment policies and objectives of the Iowa Diocesan Foundation Fund to assist the Investment Committee and Board of Directors of the Episcopal Corporation of the Diocese of Iowa (Board) and the Investment Consultant in effectively supervising, monitoring and evaluating investments. This policy outlines an overall philosophy that is specific enough to guide the Investment Committee and/or investment consultant to allow for changes in the economy and capital markets.

This document:

Is a communication tool that outlines the Fund’s investment objectives, financial accountability practices, methods for evaluating investment performance, and annual review process.

States in a written document the Diocese’s attitudes, expectations, objectives and guidelines for the investment of its funds.

Sets forth an investment structure for managing the Portfolio. This structure includes various asset classes, investment management styles, asset allocation and acceptable ranges that, in total, are expected to produce an appropriate level of overall diversification and total return over the investment time horizon.

Encourages effective communications between the Diocese and its Investment Consultant and the money managers.

Establishes formal criteria to select, monitor, evaluate and compare the performance of invested assets on a regular basis.

Promotes applicable fiduciary, prudence and due diligence requirements that experienced investment professionals would utilize, and with all applicable laws, rules and regulations from various local, state, federal and international political entities that may impact Fund assets.

Persons appointed to execute the policy are accorded full discretion within policy limits for the diversification of fund assets.

BACKGROUND

Iowa Diocesan Foundation Fund

History

The Iowa Diocesan Foundation Fund was established in 1959 and offers a convenient, professionally managed investment fund for the congregations of the Diocese of Iowa, and some of the special purpose funds given to the Diocese. By creating a common pool of investable funds, participants are able to invest in a well-diversified portfolio.

Harris Bank, now BMO Investment Management of Chicago, Illinois, has been retained as investment advisor by the Board of Directors of the Episcopal Corporation since its inception. Until 2004, the fund distributed only dividend and interest income, a common practice at the time. Beginning in 2004, annual distribution rates were determined by the Investment Committee and approved by the Board of Directors of the Episcopal Corporation of Iowa.

The Investment Committee reviewed its Investment Policy in 2013 and revised the Investment Policy Statement and allowed the use of an investment consultant to assist with fiduciary oversight of the investments, as well assisting the Diocese to maintain an updated Investment Policy Statement. The Board of Directors of the Episcopal Corporation of the Diocese of Iowa approved these decisions June 28, 2013.

Participating Shares and Distributions

Participating shares in the Foundation are acquired in direct proportion to the size of each fund or gift, thus providing a means of preserving the identity of each. The Fund is divided into units, and the proportionate share of each participating organization is evidenced by the number of units allocated.

Valuation dates are fixed by the Foundation as the last day of each month. Units may be issued or withdrawn on the first day of each month, provided that such request to make investment or withdrawal has been received at the office of the Diocese of Iowa at least one week prior to the valuation date on which investment or withdrawal is to take place.

The annual distribution rate is based on a total return approach to distribution rates that can more evenly benefit current and future beneficiaries of the Foundation’s assets. The average value is calculated over a rolling three-year period ending September 30. This distribution is made monthly, and participants may reinvest their earnings if they chose to do so.

The 2013 distribution rate is 5% (before fees) of the total portfolio’s average value.

Audited financial statements are available for review at the Diocesan Office.

STATEMENT OF OBJECTIVES

The objective of the Fund has been established in conjunction with a comprehensive review of the current and projected financial requirements. The Diocese seeks to maximize its financial returns within prudent levels of risk while also meeting the following investment objectives:

Maximize long-term capital appreciation within reasonable and prudent levels of risk in an attempt to maintain the purchasing power of the current assets and all future contributions by producing positive real rates of return on Fund assets.

Maintain an appropriate asset allocation based upon a total return spending policy of up to 5% of a three-year (twelve quarter) rolling average of the market value of the total investments. The rolling average will be calculated by quarter for each year ending September 30. Requests for distributions shall be made by the Investment Committee and require Board approval.

Expenditure (distributions that exceed 5% of a three-year rolling average of the market value of total investments) requests shall be made by through the Board and require Board approval.

Monitor and control the ongoing costs of administering the Fund and managing the investments.

Time Horizon

The investment guidelines are based upon an investment horizon of greater than ten years, so that interim fluctuations and economic cycles may be viewed with appropriate perspective. Similarly, the Fund’s strategic asset allocation is based on this long-term perspective.

Risk Tolerances

The Diocese acknowledges that a reasonable amount of risk must be assumed in order to achieve its long-term investment objectives. However, the Diocese’s ability to tolerate short and intermediate term variability should be considered in light of anticipated cash flow needs during the annual review of this statement.

In summary, the organization’s prospects for the future, current financial condition, and several other factors, suggest collectively that the Fund can tolerate some interim fluctuations in market value and rates of return in order to achieve long-term objectives.

Performance Expectations

The target investment objective is a long-term rate of return on assets 3% greater than the anticipated rate of inflation as measured by the Consumer Price Index (CPI). The target rate of return for the Fund has been based upon the assumption that future real returns will approximate the long-term rates of return experienced for each asset class in the IPS.

The Investment Committee realizes that market performance varies and that a target rate of return may not be meaningful during some periods. Accordingly, relative performance benchmarks for the managers are set forth in the "Control Procedures" section.

Over a complete market cycle, the Fund’s overall annualized total return, after deducting for consultancy, money management, and custodial fees, as well as total transaction costs, should perform above the median of a Balanced fund universe and above a customized index comprised of market indices weighted by the strategic asset allocation of the Fund.

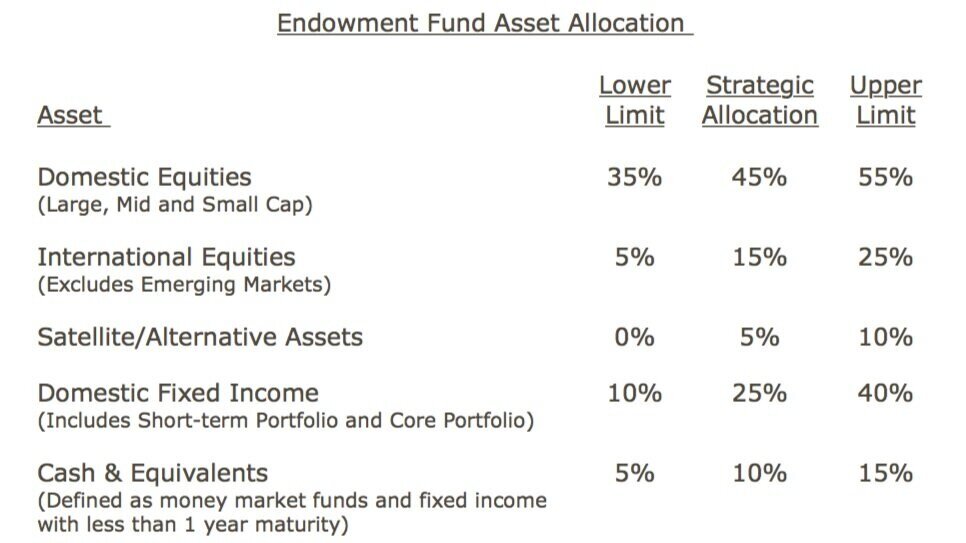

Asset Allocation Constraints

The Committee believes that the Fund's risk and return characteristics, in large part, are a function of asset allocation. The Committee has reviewed the long-term performance characteristics of various asset classes, focusing on balancing the risks and rewards of market behavior. The following asset classes were selected:

• Domestic Large Capitalization Equities

• Domestic Mid Capitalization Equities

• Domestic Small Capitalization Equities

• International Equities

• Emerging Market Equities

• Domestic Fixed Income

• Cash Equivalents

• Satellite/Alternative Assets may be used - consisting of, but not limited to:

► High Yield

► Real Estate

► Commodity/Natural Resources

► Absolute Return Strategies/Hedge Funds

► Foreign Debt

Rebalancing of Strategic Allocation

The percentage allocation to each asset class may vary as much as plus or minus 10% depending upon market conditions.

When necessary and/or available, cash inflows/outflows will be deployed in a manner consistent with the strategic asset allocation of the Fund.

If cash flows are insufficient to bring the Fund within the strategic allocation ranges, transactions may be initiated to bring the strategic allocation within the threshold ranges (Strategic Allocation).

SECURITIES GUIDELINES

The manager selected to manage the Fund’s assets must adhere to the following guidelines. The following securities and transactions are not authorized unless prior Committee approval has been obtained:

(1) Direct investment letter stock and other unregistered securities; commodities or other commodity contracts; and short sales or margin transactions.

(2) Direct activity that involves securities lending; pledging or hypothecating securities.

(3) Direct investments in equity securities of any company with a record of less than three years of continuous operation, including the operation of any predecessor.

(4) Direct investments for the purpose of exercising control of management.

(5) Direct investments in issues identified by the Investment Committee as socially unacceptable are ineligible for purchase. Issues whose status changes after acquisition shall be reviewed by the Diocesan Investment Committee on a case-by-case basis.

(6) Direct investments in tobacco holdings are prohibited with the exception of holdings in mutual funds.

For the purpose of this Investment Policy Statement, a direct investment is defined as the intentional purchase or acquisition of a specific publicly or privately traded company for the sole purpose of acquiring an ownership position. An investment in a mutual fund that may hold a nominal position(s) in a company(s) that may fail to meet the SRI standards shall not be deemed a violation of this Investment Policy Statement.

Domestic Equities:

Equity holdings in any one company should not exceed 10% of the market value of the Fund's equity portfolio.

Allocation to any one economic sector should not be excessive and should be consistent relative to the broad equity market and to managers following similar style disciplines.

The manager shall emphasize quality in security selection and shall avoid risk of large loss through diversification.

The managers shall have the discretion to invest a portion of the assets in cash reserves when they deem appropriate. However, the managers will be evaluated against their peers on the performance of the total funds under their direct management.

Holdings of individual securities shall be large enough for easy liquidation.

Domestic Fixed Income:

All fixed-income securities directly held in the portfolios shall have a Moody's, Standard & Poor's and/or a Fitch's credit quality rating of no less than "BBB" (investment grade). U.S. Treasury and U.S. government agencies, which are unrated securities, are qualified for inclusion in the portfolio.

No more than 20% of the market value of the fixed income portfolio (including mutual funds) shall be rated less than BBB (investment grade) quality, unless the manager has specific written authorization.

The exposure of the portfolio to any one issuer, other than securities of the U.S. government or agencies/government sponsored enterprises, shall not exceed 10% of the market value of the fixed income portfolio.

Bank deposits should not exceed FDIC insured limits per institution.

Holdings of individual issues shall be large enough for easy liquidation.

International Equities and Emerging Markets:

Equity holdings in any one company shall not exceed 10% of the International Equity portfolio.

Allocation to any one economic sector should not be excessive and should be consistent relative to a broadly diversified international equity market and to managers following similar style disciplines.

Allocations to any specific country shall not be excessive relative to a broadly diversified international equity manager peer group. It is expected that the non-U.S. equity portfolio will have no more than 40% in any one country.

The manager may enter into foreign exchange contracts on currency provided that use of such contracts is limited to hedging currency exposure existing within the manager's portfolio. There shall be no direct foreign currency speculation or any related investment activity.

Cash/Cash Equivalents:

Cash equivalent reserves shall consist of cash instruments having a quality rating of A-2, P-2 or higher. Eurodollar Certificates of Deposits, time deposits, and repurchase agreements are also acceptable investment vehicles.

Any idle cash not invested by the investment managers shall be invested through an automatic interest bearing sweep vehicle managed by the custodian.

FDIC insured bank deposits such as checking accounts, savings accounts and/or certificates of deposit.

SELECTION OF MONEY MANAGERS

The Committee, with the assistance of the Investment Consultant, will select appropriate money managers to manage the Fund’s assets. Managers must meet the following minimum criteria:

Be a bank, insurance company, investment management company, or investment adviser as defined by the Registered Investment Advisers Act of 1940.

Provide historical performance numbers calculated on a time-weighted basis, based on a composite of all fully discretionary accounts of similar investment style, and reported gross of fees.

Provide performance evaluation reports prepared by an objective third party that illustrate the risk/return profile of the manager relative to other managers of like investment style.

Provide detailed information on the history of the firm, key personnel and fee schedule.

Clearly articulate the investment strategy that will be followed and document that the strategy has been adhered to over time.

Selected firms shall have no known outstanding legal judgments or past judgments which may reflect negatively upon the firm.

Mutual funds utilized to manage Fund assets must meet the following minimum criteria:

Funds must correspond to the asset classes outlined in this IPS. For example, the growth component of the IPS must be implemented with a mutual fund invested in growth stocks.

It is desired the fund’s manager have been in place for three years or more.

The funds must have been following the same investment strategy for at least three years.

The fund must have sufficient assets under management so that any single client does not represent more than 10% of the fund.

It is desired that shares be purchased and sold at Net Asset Value (NAV).

CONTROL PROCEDURES

Duties and Responsibilities of the Money Managers

The duties and responsibilities of each money manager retained by the Consultant include the following:

Managing the Fund assets under its care, custody and/or control in accordance with the IPS objectives and guidelines set forth herein, and may also be expressed in separate written agreements when deviation is deemed prudent and desirable.

Exercising investment discretion (including holding cash equivalents as an alternative) within the IPS objectives and guidelines set forth herein.Promptly informing the Committee in writing regarding all significant and/or material matters and changes pertaining to the investment of Fund assets, including, but not limited to:

Promptly informing the Committee in writing regarding all significant and/or material matters and changes pertaining to the investment of Fund assets, including, but not limited to:

a. Investment strategy

b. Portfolio structure

c. Tactical approaches

d. Ownership

e. Organizational structure

f. Financial condition

g. Professional staff

h. Recommendations for guideline changesThe investment manager(s) of direct investments in individual equity issues (i.e. excluding mutual and exchange-traded funds) shall make a good-faith effort to vote all proxies and related actions in a manner consistent with the long-term interests and objectives of the Fund and in a manner consistent with the church’s objectives. Each manager shall keep detailed records of said voting of proxies and related actions and will comply with all regulatory obligations related thereto.

Utilize the same care, skill, prudence and due diligence under the circumstances then prevailing that experienced, investment professionals acting in a like capacity and fully familiar with such matters would use in like activities for like retirement Funds with like aims in accordance and compliance with applicable laws, rules and regulations from local, state, federal entities as it pertains to fiduciary duties and responsibilities.

Acknowledge and agree in writing to their fiduciary responsibility to fully comply with the entire IPS set forth herein, and as modified in the future.

Mutual Funds. Each mutual fund selected by the Consultant to manage Fund assets must adhere to the terms and conditions set forth in its prospectus.

Performance Objectives

Investment performance will be reviewed at least annually to determine the continued feasibility of achieving the investment objectives and the appropriateness of the IPS for achieving those objectives.

It is not expected that the IPS will change frequently. In particular, short-term changes in the financial markets should not require adjustments to the IPS.

Monitoring of Funds/Money Managers

Performance will be evaluated to test progress toward the attainment of longer term targets. It is understood that there are likely to be short term periods during which performance deviates from appropriate indices and benchmarks. During such times, greater emphasis shall be placed on peer-performance comparisons with funds/managers employing similar styles.

On a timely basis, but not less than annually, the Committee will meet to focus on:

Fund’s/Manager's adherence to the IPS guidelines;

Material changes in the fund’s/manager's organization, investment philosophy and/or personnel; and,

Comparisons of the fund’s/manager's results to appropriate indices and peer groups.

The risk associated with each fund’s/manager’s portfolio should not exceed that of the benchmark index and the peer group without a corresponding increase in performance above the benchmark and peer group.

In addition to the information covered during the annual review, the Committee will meet at least annually to focus on the fund’s/manager's performance relative to managers of like investment style or strategy. Each fund/manager is expected to perform in the upper half of the manager's respective style universe.

The Committee is aware that the ongoing review and analysis of funds/money managers is just as important as the due diligence implemented during the fund/manager selection process. Accordingly, a thorough review and analysis of a fund/money manager will be conducted, should:

A Fund/Manager perform in the bottom quartile (75th percentile) of their peer group over 3 consecutive annual periods.

A Fund/Manager fall in the southeast quadrant of the risk/return scatterplot for a 5-year time period.

A Fund/Manager have a 5-year risk adjusted return fall below that of the median within the appropriate peer group.

Furthermore, performance which may require the replacement of a Fund/Manager include:

Funds/Managers that consistently perform below the median (50th percentile) of their peer group over rolling 3- year periods.

Funds/Managers which perform below the median (50th percentile) of their peer group over a 5- year period.

Funds/Managers with negative alphas (compared to an appropriate benchmark) for a 5-year time periods.

Major organizational changes also warrant immediate review of the fund/manager, including:

Change in professionals

Significant account losses

Significant growth of new business

Change in ownership

Investment Committee

It is the responsibility of the Investment Committee and the Board to insure that the needs and intentions of the Diocese are well served. The Diocese authorizes the Investment Committee to act on its behalf in communicating with an Investment Consultant/Manager. Further, the Investment Committee is responsible to the Board for supervising the investments on an on-going basis and insuring that the principles outlined in this statement are followed. The Board directs the Investment Committee to review this document annually in consultation with the Investment Consultant/Manager and present any changes via an annual report to the Board.

IOWA DIOCESAN EPISCOPATE FUND

December 19, 2018

TABLE OF CONTENTS

I. Executive Summary

II. Purpose

III. Background

• History

• Distributions

IV. Statement of Objectives

• Time Horizon

• Risk Tolerances

• Performance Expectations

• Asset Allocation Constraints

• Rebalancing of Strategic Allocation

V. Securities Guidelines

• Domestic Equities

• Domestic Fixed Income

• International Equities and Emerging Markets

• Cash/Cash Equivalents

VI. Selection of Money Managers

VII. Control Procedures

• Duties and Responsibilities of the Money Managers

• Brokerage Policy

• Performance Objectives

• Monitoring of Money Managers

I. EXECUTIVE SUMMARY

Type of Fund: Endowment / Long-Term Investment Account

Assets as of December 31, 2017: $1,737,693.11

Aggregate Target Long-Term Return: CPI + 3%

Alternative assets

Satellite/Alternative asset categories might include, but are not be limited to, REITS, High Yield Debt, Commodities, Hedge Funds and Foreign Debt. It is generally recognized that these types of asset classes are not highly correlated to domestic and large cap international stocks. The use of non-correlated asset classes is intended to provide broader diversification to the portfolio and to reduce overall portfolio volatility. Alternative asset classes are counted as part of the equity exposure.

Evaluation Benchmark

Total return is expected to meet or exceed performance of a Balanced Fund database or a weighted index of appropriate indices.

II. PURPOSE

The purpose of this investment policy statement (IPS) is to establish the investment policies and objectives of the Iowa Diocesan Episcopate Fund to assist the Investment Committee and Board of Directors of the Episcopal Corporation of the Diocese of Iowa (Board) and the Investment Consultant in effectively supervising, monitoring and evaluating investments. This policy outlines an overall philosophy that is specific enough to guide the Investment Committee and/or investment consultant to allow for changes in the economy and capital markets.

This document:

Is a communication tool that outlines the Fund’s investment objectives, financial accountability practices, methods for evaluating investment performance, and annual review process.

States in a written document the Diocese’s attitudes, expectations, objectives and guidelines for the investment of its funds.

Sets forth an investment structure for managing the Portfolio. This structure includes various asset classes, investment management styles, asset allocation and acceptable ranges that, in total, are expected to produce an appropriate level of overall diversification and total return over the investment time horizon.

Encourages effective communications between the Diocese and its Investment Consultant and the money managers.

Establishes formal criteria to select, monitor, evaluate and compare the performance of invested assets on a regular basis.

Promotes applicable fiduciary, prudence and due diligence requirements that experienced investment professionals would utilize, and with all applicable laws, rules and regulations from various local, state, federal and international political entities that may impact Fund assets.

Persons appointed to execute the policy are accorded full discretion within policy limits for the diversification of fund assets.

III. BACKGROUND

A. History

The Iowa Diocesan Episcopate Fund was established by a special gift to support the expenses of the office of the Bishop of the Diocese of Iowa. A separate Foundation Fund manages general endowments of the Diocese and member congregations of the Diocese of Iowa.

Wells Fargo Advisors has been retained as investment advisor by the Board of Directors of the Episcopal Corporation since the inception of the Fund. Until 2004, the fund distributed only dividend and interest income, a common practice at the time. Beginning in 2004, annual distribution rates were determined by the Investment Committee and approved by the Board of Directors of the Episcopal Corporation of Iowa.

The Investment Committee reviewed its Investment Policy for the Foundation Fund in 2013 and revised the Investment Policy Statement and allowed the use of an investment consultant to assist with fiduciary oversight of the investments, as well assisting the Diocese to maintain an updated Investment Policy Statement. The Board of Directors of the Episcopal Corporation of the Diocese of Iowa approved these decisions June 28, 2013. This Policy is intended to align the management of the Episcopate Fund with that of the Foundation Fund while allowing the use of separate managers for the two funds.

B. Distributions

The 2018 distribution rate is 6% (before fees) of the total portfolio’s average value. The Board, advised by the Investment Committee, may adjust the level of distribution rate, considering the long-term sustainability of the Fund and the current needs of the Diocese’s operating budget.

Audited financial statements are available for review at the Diocesan Office.

IV. STATEMENT OF OBJECTIVES

The objective of the Fund has been established in conjunction with a comprehensive review of the current and projected financial requirements. The Diocese seeks to maximize its financial returns within prudent levels of risk while also meeting the following investment objectives:

Maximize long-term capital appreciation within reasonable and prudent levels of risk in an attempt to maintain the purchasing power of the current assets and all future contributions by producing positive real rates of return on Fund assets.

Maintain an appropriate asset allocation based upon a total return spending policy of up to 5% of a three-year (twelve quarter) rolling average of the market value of the total investments. The rolling average will be calculated by quarter for each year ending September 30. Requests for distributions shall be made by the Investment Committee and require Board approval[WHS1].

Expenditure (distributions that exceed 5% of a three-year rolling average of the market value of total investments) requests shall be made by through the Board and require Board approval.

Monitor and control the ongoing costs of administering the Fund and managing the investments.

A. Time Horizon

The investment guidelines are based upon an investment horizon of greater than ten years, so that interim fluctuations and economic cycles may be viewed with appropriate perspective. Similarly, the Fund’s strategic asset allocation is based on this long-term perspective.

B. Risk Tolerances

The Diocese acknowledges that a reasonable amount of risk must be assumed in order to achieve its long-term investment objectives. However, the Diocese’s ability to tolerate short and intermediate term variability should be considered in light of anticipated cash flow needs during the annual review of this statement.

In summary, the organization’s prospects for the future, current financial condition, and several other factors, suggest collectively that the Fund can tolerate some interim fluctuations in market value and rates of return in order to achieve long-term objectives.

C. Performance Expectations

The target investment objective is a long-term rate of return on assets 3% greater than the anticipated rate of inflation as measured by the Consumer Price Index (CPI). The target rate of return for the Fund has been based upon the assumption that future real returns will approximate the long-term rates of return experienced for each asset class in the IPS.

The Investment Committee realizes that market performance varies and that a target rate of return may not be meaningful during some periods. Accordingly, relative performance benchmarks for the managers are set forth in the "Control Procedures" section.

Over a complete market cycle, the Fund’s overall annualized total return, after deducting for consultancy, money management, and custodial fees, as well as total transaction costs, should perform above the median of a Balanced fund universe and above a customized index comprised of market indices weighted by the strategic asset allocation of the Fund.

D. Asset Allocation Constraints

The Committee believes that the Fund's risk and return characteristics, in large part, are a function of asset allocation. The Committee has reviewed the long-term performance characteristics of various asset classes, focusing on balancing the risks and rewards of market behavior. The following asset classes were selected:

• Domestic Large Capitalization Equities

• Domestic Mid Capitalization Equities

• Domestic Small Capitalization Equities

• International Equities

• Emerging Market Equities

• Domestic Fixed Income

• Cash Equivalents

• Satellite/Alternative Assets - consisting of, but not limited to:

o High Yield

o Real Estate

o Commodity/Natural Resources

o Absolute Return Strategies/Hedge Funds

o Foreign Debt

E. Rebalancing of Strategic Allocation

The percentage allocation to each asset class may vary as much as plus or minus 10% depending upon market conditions.

When necessary and/or available, cash inflows/outflows will be deployed in a manner consistent with the strategic asset allocation of the Fund.

If cash flows are insufficient to bring the Fund within the strategic allocation ranges, transactions may be initiated to bring the strategic allocation within the threshold ranges (Strategic Allocation).

V. SECURITIES GUIDELINES

The manager selected to manage the Fund’s assets must adhere to the following guidelines. The following securities and transactions are not authorized unless prior Committee approval has been obtained:

Direct investment letter stock and other unregistered securities; commodities or other commodity contracts; and short sales or margin transactions.

Direct activity that involves securities lending; pledging or hypothecating securities.

Direct investments in equity securities of any company with a record of less than three years of continuous operation, including the operation of any predecessor.

Direct investments for the purpose of exercising control of management.

Direct investments in issues identified by the Investment Committee as socially unacceptable are ineligible for purchase. Issues whose status changes after acquisition shall be reviewed by the Diocesan Investment Committee on a case-by-case basis.

Direct investments in tobacco holdings are prohibited with the exception of holdings in mutual funds.

For the purpose of this Investment Policy Statement, a direct investment is defined as the intentional purchase or acquisition of a specific publicly or privately traded company for the sole purpose of acquiring an ownership position. An investment in a mutual fund that may hold a nominal position(s) in a company(s) that may fail to meet the SRI standards shall not be deemed a violation of this Investment Policy Statement.

A. Domestic Equities:

Equity holdings in any one company should not exceed 10% of the market value of the Fund's equity portfolio.

Allocation to any one economic sector should not be excessive and should be consistent relative to the broad equity market and to managers following similar style disciplines.

The manager shall emphasize quality in security selection and shall avoid risk of large loss through diversification.

The managers shall have the discretion to invest a portion of the assets in cash reserves when they deem appropriate. However, the managers will be evaluated against their peers on the performance of the total funds under their direct management.

Holdings of individual securities shall be large enough for easy liquidation.

B. Domestic Fixed Income:

All fixed-income securities directly held in the portfolios shall have a Moody's, Standard & Poor's and/or a Fitch's credit quality rating of no less than "BBB" (investment grade). U.S. Treasury and U.S. government agencies, which are unrated securities, are qualified for inclusion in the portfolio.

No more than 20% of the market value of the fixed income portfolio (including mutual funds) shall be rated less than BBB (investment grade) quality, unless the manager has specific written authorization.

The exposure of the portfolio to any one issuer, other than securities of the U.S. government or agencies/government sponsored enterprises, shall not exceed 10% of the market value of the fixed income portfolio.

Bank deposits should not exceed FDIC insured limits per institution.

Holdings of individual issues shall be large enough for easy liquidation.

C. International Equities and Emerging Markets:

Equity holdings in any one company shall not exceed 10% of the International Equity portfolio.

Allocation to any one economic sector should not be excessive and should be consistent relative to a broadly diversified international equity market and to managers following similar style disciplines.

Allocations to any specific country shall not be excessive relative to a broadly diversified international equity manager peer group. It is expected that the non-U.S. equity portfolio will have no more than 40% in any one country.

The manager may enter into foreign exchange contracts on currency provided that use of such contracts is limited to hedging currency exposure existing within the manager's portfolio. There shall be no direct foreign currency speculation or any related investment activity.

D. Cash/Cash Equivalents:

Cash equivalent reserves shall consist of cash instruments having a quality rating of A-2, P-2 or higher. Eurodollar Certificates of Deposits, time deposits, and repurchase agreements are also acceptable investment vehicles.

Any idle cash not invested by the investment managers shall be invested through an automatic interest bearing sweep vehicle managed by the custodian.

FDIC insured bank deposits such as checking accounts, savings accounts and/or certificates of deposit.

VI. SELECTION OF MONEY MANAGERS

The Committee, with the assistance of the Investment Consultant, will select appropriate money managers to manage the Fund’s assets. Managers must meet the following minimum criteria:

Be a bank, insurance company, investment management company, or investment adviser as defined by the Registered Investment Advisers Act of 1940.

Provide historical performance numbers calculated on a time-weighted basis, based on a composite of all fully discretionary accounts of similar investment style, and reported gross of fees.

Provide performance evaluation reports prepared by an objective third party that illustrate the risk/return profile of the manager relative to other managers of like investment style.

Provide detailed information on the history of the firm, key personnel and fee schedule.

Clearly articulate the investment strategy that will be followed and document that the strategy has been adhered to over time.

Selected firms shall have no known outstanding legal judgments or past judgments which may reflect negatively upon the firm.

Mutual funds utilized to manage Fund assets must meet the following minimum criteria:

Funds must correspond to the asset classes outlined in this IPS. For example, the growth component of the IPS must be implemented with a mutual fund invested in growth stocks.

It is desired the fund’s manager have been in place for three years or more.

The funds must have been following the same investment strategy for at least three years.

The fund must have sufficient assets under management so that any single client does not represent more than 10% of the fund.

It is desired that shares be purchased and sold at Net Asset Value (NAV).

VII. CONTROL PROCEDURES

A. Duties and Responsibilities of the Money Managers

The duties and responsibilities of each money manager retained by the Consultant include the following:

Managing the Fund assets under its care, custody and/or control in accordance with the IPS objectives and guidelines set forth herein, and may also be expressed in separate written agreements when deviation is deemed prudent and desirable.

Exercising investment discretion (including holding cash equivalents as an alternative) within the IPS objectives and guidelines set forth herein.

Promptly informing the Committee in writing regarding all significant and/or material matters and changes pertaining to the investment of Fund assets, including, but not limited to:

a. Investment strategy

b. Portfolio structure

c. Tactical approaches

d. Ownership

e. Organizational structure

f. Financial condition

g. Professional staff

h. Recommendations for guideline changesThe investment manager(s) of direct investments in individual equity issues (i.e. excluding mutual and exchange-traded funds) shall make a good-faith effort to vote all proxies and related actions in a manner consistent with the long-term interests and objectives of the Fund and in a manner consistent with the church’s objectives. Each manager shall keep detailed records of said voting of proxies and related actions and will comply with all regulatory obligations related thereto.

Utilize the same care, skill, prudence and due diligence under the circumstances then prevailing that experienced, investment professionals acting in a like capacity and fully familiar with such matters would use in like activities for like retirement Funds with like aims in accordance and compliance with applicable laws, rules and regulations from local, state, federal entities as it pertains to fiduciary duties and responsibilities.

Acknowledge and agree in writing to their fiduciary responsibility to fully comply with the entire IPS set forth herein, and as modified in the future.

Mutual Funds. Each mutual fund selected by the Consultant to manage Fund assets must adhere to the terms and conditions set forth in its prospectus.

B. Performance Objectives

Investment performance will be reviewed at least annually to determine the continued feasibility of achieving the investment objectives and the appropriateness of the IPS for achieving those objectives.

It is not expected that the IPS will change frequently. In particular, short-term changes in the financial markets should not require adjustments to the IPS.

C. Monitoring of Funds/Money Managers

Performance will be evaluated to test progress toward the attainment of longer term targets. It is understood that there are likely to be short term periods during which performance deviates from appropriate indices and benchmarks. During such times, greater emphasis shall be placed on peer-performance comparisons with funds/managers employing similar styles.

On a timely basis, but not less than annually, the Committee will meet to focus on:

Fund’s/Manager's adherence to the IPS guidelines;

Material changes in the fund’s/manager's organization, investment philosophy and/or personnel; and,

Comparisons of the fund’s/manager's results to appropriate indices and peer groups.

The risk associated with each fund’s/manager’s portfolio should not exceed that of the benchmark index and the peer group without a corresponding increase in performance above the benchmark and peer group.

In addition to the information covered during the annual review, the Committee will meet at least annually to focus on the fund’s/manager's performance relative to managers of like investment style or strategy. Each fund/manager is expected to perform in the upper half of the manager's respective style universe.

The Committee is aware that the ongoing review and analysis of funds/money managers is just as important as the due diligence implemented during the fund/manager selection process. Accordingly, a thorough review and analysis of a fund/money manager will be conducted, should:

A Fund/Manager perform in the bottom quartile (75th percentile) of their peer group over 3 consecutive annual periods.

A Fund/Manager fall in the southeast quadrant of the risk/return scatterplot for a 5-year time period.

A Fund/Manager have a 5-year risk adjusted return fall below that of the median within the appropriate peer group.

Furthermore, performance which may require the replacement of a Fund/Manager include:

Funds/Managers that consistently perform below the median (50th percentile) of their peer group over rolling 3- year periods.

Funds/Managers which perform below the median (50th percentile) of their peer group over a 5- year period.

Funds/Managers with negative alphas (compared to an appropriate benchmark) for a 5-year time periods.

Major organizational changes also warrant immediate review of the fund/manager, including:

Change in professionals

Significant account losses

Significant growth of new business

Change in ownership

D. Investment Committee

It is the responsibility of the Investment Committee and the Board to insure that the needs and intentions of the Diocese are well served. The Diocese authorizes the Investment Committee to act on its behalf in communicating with an Investment Consultant/Manager. Further, the Investment Committee is responsible to the Board for supervising the investments on an on-going basis and insuring that the principles outlined in this statement are followed. The Board directs the Investment Committee to review this document annually in consultation with the Investment Consultant/Manager and present any changes via an annual report to the Board.